All about Personal Loans copyright

Table of Contents7 Simple Techniques For Personal Loans copyrightThe Definitive Guide to Personal Loans copyrightHow Personal Loans copyright can Save You Time, Stress, and Money.Some Known Details About Personal Loans copyright Personal Loans copyright Can Be Fun For Everyone

Allow's study what an individual loan really is (and what it's not), the factors individuals use them, and how you can cover those crazy emergency expenses without tackling the burden of financial debt. An individual lending is a round figure of cash you can obtain for. well, practically anything., however that's practically not a personal lending (Personal Loans copyright). Individual car loans are made with an actual economic institutionlike a bank, credit score union or online lending institution.

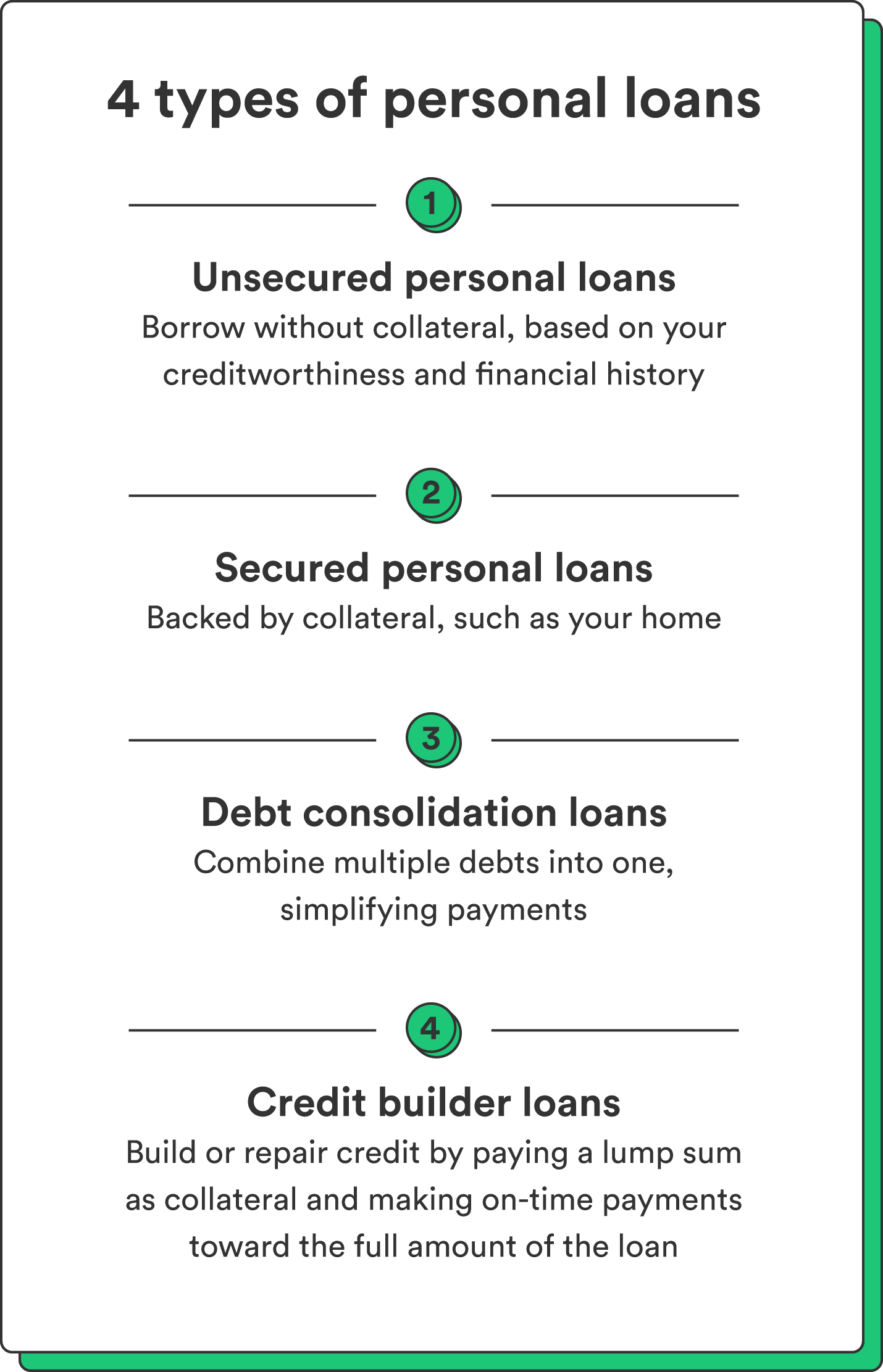

Allow's take an appearance at each so you can recognize precisely how they workand why you do not need one. Ever. Most individual fundings are unprotected, which means there's no security (something to back the funding, like a car or home). Unsecured fundings generally have higher passion prices and need a better credit rating due to the fact that there's no physical thing the loan provider can eliminate if you do not compensate.

Some Of Personal Loans copyright

Shocked? That's fine. Despite exactly how great your credit is, you'll still need to pay rate of interest on a lot of individual financings. There's always a price to pay for obtaining money. Protected individual finances, on the various other hand, have some kind of collateral to "protect" the finance, like a boat, jewelry or RVjust among others.

You can likewise take out a safeguarded personal funding using your car as security. That's a hazardous move! You do not desire your major mode of transport to and from work obtaining repo'ed since you're still paying for in 2015's cooking area remodel. Count on us, there's absolutely nothing safe and secure regarding guaranteed car loans.

Simply since the settlements are predictable, it does not imply this is a great bargain. Personal Loans copyright. Like we said before, you're basically assured to pay passion on a personal loan. Just do the math: You'll wind up paying way a lot more over time by taking out a funding than if you would certainly just paid with cash

The Basic Principles Of Personal Loans copyright

And you're the try this fish hanging on a line. An installment car loan is a personal funding you pay back in repaired installments in time (typically once a month) until it's paid completely - Personal Loans copyright. And do not miss this: You need to repay the original car loan amount before you can obtain anything else

Yet do not be misinterpreted: This isn't the like a debt card. With personal lines of credit score, you're paying passion on the loaneven if you pay in a timely manner. This kind of lending is super complicated due to the fact that it makes you believe you're managing your financial debt, when truly, it's managing you. Payday advance loan.

This one gets us provoked up. Why? Due to the fact that these businesses exploit people who can not pay their bills. Which's just incorrect. Technically, these are short-term lendings that offer you your paycheck in advance. That might sound enthusiastic when you're in an economic accident and need some cash to cover your expenses.

Personal Loans copyright Things To Know Before You Get This

Because things obtain genuine untidy real fast when you miss out on a settlement. Those creditors will come after your sweet grandmother that cosigned the car loan for you. Oh, and you ought to never guarantee a financing for anybody else either!

However all you're actually doing is utilizing new debt to repay old financial debt (and prolonging your car loan term). That just suggests you'll be paying a lot more with time. Business view it now know that toowhich is precisely why a lot of of them supply you debt consolidation fundings. A lower rates of interest does not get you out of debtyou do.

And it starts with not obtaining anymore cash. ever. This is a good general rule for any type of financial acquisition. Whether you're thinking of obtaining a personal loan to cover that cooking area remodel or your overwhelming charge card Web Site costs. don't. Obtaining debt to spend for things isn't the method to go.

The Facts About Personal Loans copyright Uncovered

And if you're considering a personal lending to cover an emergency, we obtain it. Obtaining cash to pay for an emergency only escalates the stress and challenge of the situation.

:max_bytes(150000):strip_icc()/whatsapersonalloan-49a4338af74741e7b4dbb0884a191283.jpg)